The legal industry, comprised of over 1.3 million active lawyers across the United States, represents a substantial and diverse target market for commercial banking professionals. With an assortment of law firm types, sizes, and geographic presence, banking professionals have ample opportunities to cater to this niche with specialized financial services. Below we outline who law firms are, why they make exceptional banking clients, and how banking professionals can forge profitable partnerships with them.

Understanding Law Firms

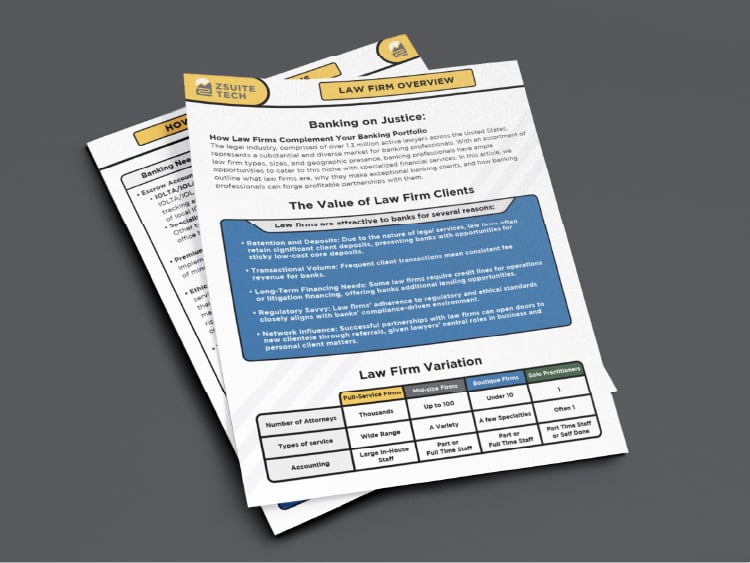

Law firms range from sprawling full-service firms with international portfolios to specialized boutique firms offering niche legal expertise. These professional service firms provide legal advice and representation to individuals, businesses, and other entities, and operate in varying scales.

The Value of Law Firm Clients

Law firms are attractive to banks for several reasons:

Retention and Deposits

Long-Term Financing Needs

Regulatory Savvy

Network Influence

Transactional Volume

Banking Needs of Law Firms

When it comes to serving law firms, generic banking products won't suffice. They require:

IOLTA/IOLA Accounts

Offer IOLTA/IOLA/IOTA account services with precise tracking and a deep understanding of state-level usage.

Specialized Trust Account Services

Multiple types of accounts where law offices hold client funds on their behalf, also known as three-party accounts.

Premium Security Protocols

Ethical Funds Management

Online and Digital Banking Tools

Customized Solutions

Transparent Reporting

How to Find Law Firm Clients

Identifying prospective law firm clients requires strategic planning and networking:

- Market Analysis: Understand your local landscape. Segment the market by firm size or specialty to identify target clients who are a good fit.

- Build Relationships Through Legal Associations: Engage with bar associations and legal trade groups.

- Showcase Your Expertise in Compliance: Banks with a track record of compliance engender trust.

- Leverage Technology and Innovation: Present cutting-edge digital banking solutions that appeal to tech-savvy and convenience-seeking firms.

- Referral Programs: Encourage word-of-mouth through existing clients in the legal niche, or ask your current clients which law firms they work with.

- Content Marketing: Share insights on financial management specifically tailored to law firms, positioning your bank as a thought leader.

In conclusion, the law firm market presents a prime opportunity for banking institutions ready to offer customized, compliant, and secure financial services. By addressing the unique needs of law firms and navigating their pain points, banks can capture a lucrative segment that promises growth and stability. Start your initiative today, and tap into a market where professionalism, precision, and partnership go hand in hand.

Additional resources

There are a lot of organizations and resources you can start conversations and engage with.

- American Bar Association (ABA)

With 200,000+ members, ABA is the prominent organization representing legal professionals. - International Legal Technology Association (ILTA)

A global resource community for the legal sector. - Legalweek Conference

A week in which thousands of legal professionals gather to explore the Business and Regulatory Trends, Technology and Talent drivers impacting the industry.

Here are some additional news and media channels to keep up with what law firms are up to:

2023 Report on the State of the Legal Market: Mixed results and growing uncertainty - Thomson Reuters Institute

Media & Entertainment : Law360 : Legal News & Analysis News | The American Lawyer

Legal News & Business Law News | The National Law Review (natlawreview.com)