Make Commercial Banking Easier with ZEscrow

Our easy to use interface allows financial institutions and your commercial customers to easily manage complex three-party accounts and sub-ledgers. You can attract new customers without increasing the internal workload.

Download

ZEscrow Information Sheet to download

Financial institutions can offer ZEscrow to a variety of organizations who need an escrow or subaccounting solution that is convenient, compliant, and full-featured.

- Anytime online access

- Bulk import capability

- Easy organization & subaccount creation, configuration and closing

- Interest configuration and calculation at the subaccount level

- White-labeled dashboard display

- Document depository

- Automated statements

- Tax filing

- Docusign integration

- Reporting capabilities

- Commercial customer and beneficiary access

- Anytime online access

- Bulk import capability

- Digital opening & closing of subaccounts

- Beneficiary Access (optional)

- Ability to invite beneficiary to Docusign W9

- Interest configurations by subaccount

- View accrued interest and rate for each subaccount

- Manage split interest in subaccount

- Automated statements

- Reporting capabilities

"What ZSuite has now done is allowed our cash management salespeople to actively promote escrow as a service with the understanding that it really doesn't matter the size or the amount of money or the amount of accounts. If the system can support it, we can support it."

SVP, Deposit Operations

$3B Northeast Bank

Check Out Our Verticals Pages:

Property Managers

1031 Exchanges

Municipalities

Law Firms

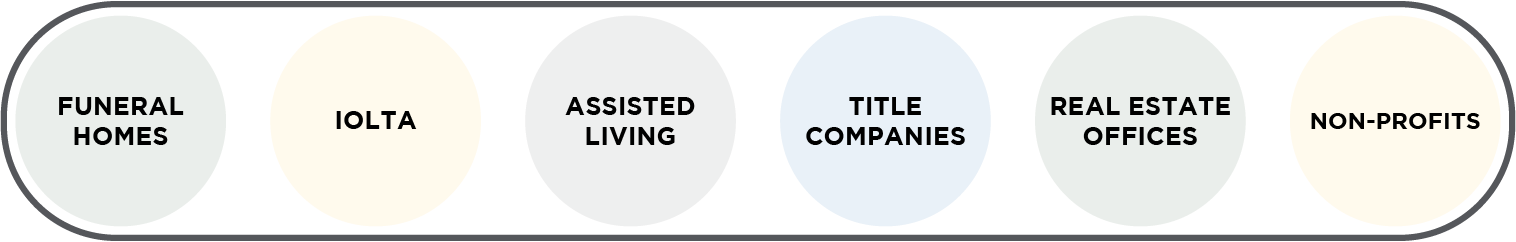

Other Verticals We Serve for Commercial Escrow:

Request a Demo

ZEscrow FAQ

We have a responsive and adaptive web-based application that can be viewed through any browser or on any device.

Our platform is hosted by AWS and we spin up a separate instance for each client, so there is no interaction between client data or environments.

Within the platform there are three levels of access.

- First, financial institution employees can access the portal you see in the demo. Employees can access all of the commercial organizations their institution has on the platform, and see the same information they see.

- Second, commercial customers can also log into the platform and access only their organization’s information, they can self-serve. They can open and close subaccounts, pull data, access statements, etc.

- Third, if there is a beneficiary attached to these accounts the organization can give them access to their own information.

We currently have multiple SSO integrations available as an option.

Our system is the system of record for all of the subaccount data.

The dollars within those subaccounts are in the holding account on your core. Our system comes on top of that account to be the system of record for the subaccounts. They never move to another bank or banking system based on actions in the ZEscrow platform. ZEscrow never holds dollars directly.

All the accounts are your accounts. The subaccounts are created and tracked on our system. This means you do not have to open or manage additional subaccounts as accounts on your core. You can hold everything in a master account and open a holding account or shadow account to support it. All activity originated on our platform is reflected in movement between these accounts.

You always own the relationship with the customer. We can support you in training and special use cases, but you own the relationship.

The financial institution is responsible for all compliance relating to their customers using this system. There’s no change in BSA or CIP policy when onboarding new clients.

ZSuite handles all daily OFAC checks on every active beneficiary within the platform. Those beneficiaries are not clients of the financial institution.

No, there is no limit.

On the financial institution side, the money moves between the master account and the shadow account, as necessary. In the instances of opening and closing accounts money is moved by the bank into and out of the master account.

On the ZEscrow side, the tracking for money movements in and out of different subaccounts takes place, so your financial institution, your corporate partner and their beneficiaries can all see the balances for each individual subaccount.

Interest can be calculated by ZEscrow, and instructions to move from the GL account to the holding account are passed to the bank in the daily transaction file/transaction exchange. ZEscrow tracks the interest accrued for each beneficiary, including when there is a split between a beneficiary and a partner or IOLTA board.

Every subaccount is issued a unique account number. When funds are transferred in and out of the subaccount via the ZEscrow platform, we are able to auto reconcile those transactions within the UI based on that unique account number.

ZEscrow is the system of record therefore statements will be auto-generated monthly by the ZSuite Tech platform. PDFs will be delivered and stored to the platform.

Tax reporting is a collaborative process between your financial institution and the team at ZSuite Tech. ZSuite Tech provides the annual interest data for both organizations and beneficiaries, and your financial institution verifies its accuracy. Once the information is confirmed, the required 1099-INT forms are mailed to recipients by ZSuite Tech and filed on your behalf.

After your financial institution reviews and sends the finalized interest data, ZSuite Tech submits the required tax forms (such as 1099s) to the IRS on your behalf.

No formal verification is performed on W-9 forms or data within the ZEscrow system. The individual submitting the form is responsible for ensuring its accuracy. However, some financial institutions may independently review the data and provide corrections to ZSuite Tech to be made within the platform.

The commercial customer accepts this pass-through responsibility in the Terms and Conditions that are required to use the platform.

Yes! We can do bulk uploads of any size, and recommend it for any addition or migration over 10 subaccounts.