Specialty deposits: 1031 Exchanges and qualified intermediaries

by Zac Garver on Mar 7, 2023 11:57:04 AM

What is a 1031 Exchange?

In 1921, the IRS created a provision that allows taxpayers to sell and purchase property (not strictly real estate) without recognizing a loss or gain in the transaction in that tax year. Hence a 1031 Exchange is a form of tax deferment. This meant that people could take one investment, sell it and purchase another investment without affecting their income tax liability – provided that certain rules were followed. More than 100 years later, 1031 Exchanges look different but function with a similar purpose.

The federal and state rules governing 1031 Exchanges (1031s for short) are specific and inflexible. There are many ways for the transaction to fall out of compliance and leave the taxpayer with a massive capital gains tax burden. Although a federal statute, any state that assesses capital gains tax can also layer on their own rules for how 1031s work in their jurisdiction. Consequently, an industry has risen to facilitate these transactions and keep everything compliant.

Who uses 1031s, and who facilitates them?

Section 1031 of the Internal Revenue Code originally permitted businesses and individuals to take a physical asset, such as a building, plot of land, or even a vehicle, such as a car, and essentially trade it for another asset or assets of like kind. You may even hear 1031 Exchanges referred to as “like-kind exchanges.” This means real estate for real estate, but not a building for a car or a property for an airplane, as long as the asset is being put to a similar business purpose. In 2018, the Tax Cuts and Jobs Act limited like-kind exchange treatment to real property only, not including personal or intangible property such as vehicles, artwork, collectibles, patents, or intellectual property.

For example, a landlord could sell a rental property at a profit. She could then reinvest the proceeds from that sale into two new rental properties, increasing her passive income without paying any more capital gains tax. The landlord could not use the proceeds to purchase another rental home and also a personal residence since that application would no longer classify as a property used for trade, business or investment.

One of the most important rules of a 1031 is the time window: 180 days from start to finish. Once a taxpayer initiates the transaction, the clock starts ticking. They have 45 days to identify a replacement asset or assets and the remaining 135 days to close on the purchase of the new assets.

Another important rule is how the proceeds of the transaction can be handled. The taxpayers must place the funds in a “qualified escrow account” at a bank, and the entire transaction must be facilitated by a qualified intermediary (QI), someone who has not had any kind of business relationship in the prior two years with the entity that initiated the transaction. This rule is meant to prevent conflict of interest between QIs and their clients.

A QI can be a company or an individual. There are QI firms dedicated to 1031s. There are also banks with QI departments. Currently, some of the largest QI firms are held by title companies, but it’s not unusual for individual realtors, attorneys, and CPAs to also operate as QIs, provided they maintain the proper relational distance from the 1031 client.

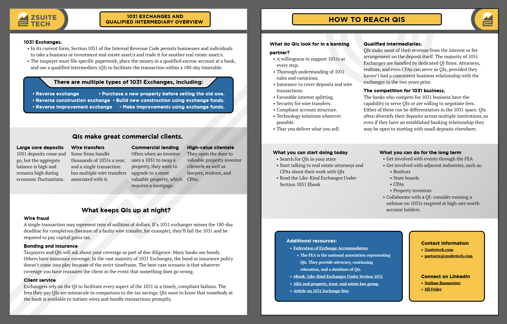

QIs have very specific needs.

A dedicated QI can handle thousands of transactions a year worth tens or hundreds of millions of dollars. Thus, they need a trustworthy financial institution to hold those deposits and facilitate the wire transfer of the money in and out of the qualified escrow account.

Wire fraud is one of the most significant concerns for QIs. Ideally, they establish strict processes with the staff at the financial institution to ensure that money comes in from the right account and is sent out to the right account.

As recently as 2008, QIs weren’t prevented from reinvesting their clients’ deposits while waiting for the 1031 to conclude (an ethically questionable practice even though it wasn’t explicitly illegal). During the financial crisis, some QIs redeployed the funds to the stock market and went bankrupt as a result, leaving their clients with little recourse to recover the funds. FDIC insurance is only enough to cover smaller 1031 transactions. Today, the proceeds of a sale for a 1031 must be held at the bank and can only be moved if signed off by all three parties: the client, the QI, and the financial institution.

Another best practice is to have additional insurance, including wire fraud insurance, to protect against loss of funds. However, the 1031 statute does not include any time extensions or exceptions on the 180-day window if, for example, the client was the victim of wire fraud. If a client fails to comply with the terms of the 1031, they will be liable for the capital gains tax on the sale of the original property.

The role of banks in facilitating 1031 Exchanges.

Some QIs may see the bank as a waystation for deposits and nothing else. In practice, banks have the opportunity to become trusted partners and integral players in the 1031 ecosystem.

Virtually all QIs make most of their revenue from the fees they negotiate with the bank for holding the deposit. The 1031 client may pay thousands of dollars to the QI, but that’s a small price when saving tens or hundreds of thousands of dollars in capital gains tax.

Now that the Federal Reserve has raised rates aggressively, the stakes for QIs and banks to reach mutually beneficial fee arrangements are also much higher. At a glance, it seems that the fees from a 1031 Exchange would be unrelated to the benchmark interest rate. In reality, 1031 fees are structured as a percentage of the transaction value and tend to fluctuate with the fed funds rate, but QIs rarely refer to their fee revenue as interest.

In short, the financial institution plays a critical role in holding the money, paying fee revenue to the QI, and ensuring the entire transaction happens securely and according to state and federal regulations.

Opportunity for banks.

Some QIs are bound to chase the best fee arrangement they can get from a financial institution without a qualm about loyalty. However, if your institution is looking for a rich source of core deposits, it may be wise to build more loyalty wherever you can, including paying QIs competitively and proactively.

The big picture of what QIs can bring to your bank goes beyond deposits. It’s common for 1031 clients to maximize their position by borrowing additional money in order to buy a larger asset or assets than they sold. 1031 clients can be anyone from a grandmother selling her rental condo in Florida to a global automotive manufacturer moving their national headquarters from California to Texas. The transaction value changes, but transaction volume stays fairly consistent. Even in a down economy, investors are trying to take advantage of lower prices, and a 1031 is a great way to do that.

QIs are looking for favorable fee arrangements and institutions that understand their business model. For institutions that build out capable teams to serve QIs and their clients, 1031s can become a vibrant source of commercial portfolio growth.

Learning more.

If you’re interested in learning more about 1031s and the QIs that accommodate them, check out our resource page!

Equip your sales team. Access the most important information captured in this new Information Sheet.

- Press (53)

- Commercial banking (16)

- Deposits (14)

- Partnerships (12)

- 1031 Exchanges (9)

- ZEscrow (9)

- Bank tech (8)

- Specialty Deposits (8)

- ZValues (6)

- Property Management (5)

- VAM (4)

- Law Firms (3)

- Liquidity Management (3)

- Municipalities (3)

- Working smart (3)

- Podcast (2)

- Webinar (2)

- Builder, Banker, Hacker, Chief (1)

- FDIC Insurance (1)

- February 2026 (1)

- December 2025 (1)

- November 2025 (1)

- September 2025 (1)

- August 2025 (4)

- July 2025 (1)

- June 2025 (2)

- May 2025 (1)

- March 2025 (1)

- February 2025 (1)

- January 2025 (1)

- December 2024 (1)

- November 2024 (1)

- October 2024 (3)

- September 2024 (2)

- August 2024 (3)

- July 2024 (2)

- June 2024 (3)

- May 2024 (6)

- April 2024 (2)

- March 2024 (5)

- February 2024 (1)

- January 2024 (2)

- December 2023 (1)

- November 2023 (3)

- October 2023 (1)

- September 2023 (1)

- August 2023 (3)

- June 2023 (3)

- May 2023 (1)

- March 2023 (6)

- February 2023 (4)

- January 2023 (4)

- December 2022 (2)

- November 2022 (6)

- October 2022 (1)

- September 2022 (1)

- August 2022 (3)

- June 2022 (1)

- May 2022 (1)

- April 2022 (5)

- March 2022 (3)

- December 2021 (2)

- September 2021 (3)

- July 2021 (2)

- June 2021 (1)

- May 2021 (1)

- April 2021 (4)

- March 2021 (3)

- February 2021 (4)

- January 2021 (2)