Specialty deposits: Municipalities

by Zac Garver on Mar 14, 2023 5:00:00 AM

In our blog on specialty deposits, we mentioned municipalities as one of the industries or categories that commercial banks should consider pursuing. In this article, we’re going to explore municipalities more in-depth. Finding sticky core deposits is essential to maintaining a healthy cost of funds in a rising rate environment. Municipalities can supply those deposits along with heavy transaction volume and loan demand. They also contribute to a diversified deposit portfolio.

For banks that want to serve the municipal niche, there’s a lot of preparation involved, but the reward is a high-value client that can be loyal for decades if the partnership flourishes. Most municipalities publish a request for proposal (RFP) and give nearby institutions a chance to bid for the contract. Due to the complex nature of the municipality’s needs, they may contract with multiple banks to achieve the desired outcome. This RFP is your primary opportunity to win municipal banking business. Your proposal should be an unambiguous representation of what your institution can deliver and set you apart from the competition.

What city CFOs want from their bank.

The stereotypical city government is not forward-thinking or technologically savvy. Stereotypes can be misleading. It’s essential to examine each municipal RFP and lay down preconceived ideas of municipal banking needs. The pandemic forced city governments to embrace new processes and technology so they could operate under lockdown. Now they have a taste of how efficient technology can be, and they want more.

One of the defining requirements in municipal RFPs up to this point in time has been the proximity of a bank branch to the city’s offices. That attitude is changing as city finance teams look for ways to reduce trips to the branch and eliminate as much cash handling as possible. You may still see requirements for a bank branch within city limits, but that isn’t because they like the idea of making trips to the branch.

At a glance, city CFOs prioritize the ability to complete transactions efficiently and remotely if possible. For banks, that means offering a wide variety of services, including, but not limited to:

- Robust online banking

- Tools such as remote deposit capture devices

- Lockboxes

- Detailed statements and reporting to help with audits

- Digital escrow, trust, and subaccounting tools*

- Comprehensive support and training for city staff

City CFOs are also looking for creative solutions to their banking challenges. They aren’t just signing deals with the lowest bidder. They’re evaluating proposals from multiple institutions and looking for the right match. If your institution can combine comprehensive service, practical technology, and creative problem-solving, you’ll stand a better chance of winning the contract.

*Varies by city and state.

A look inside a city’s books.

The RFP document should give you a clear picture of the city’s banking needs, the complexity of its accounts, and the scope of its budget. The particulars will vary significantly between states and cities. For example, municipalities in the Northeast tend to use lots of trust and escrow accounts and have heavy compliance requirements.

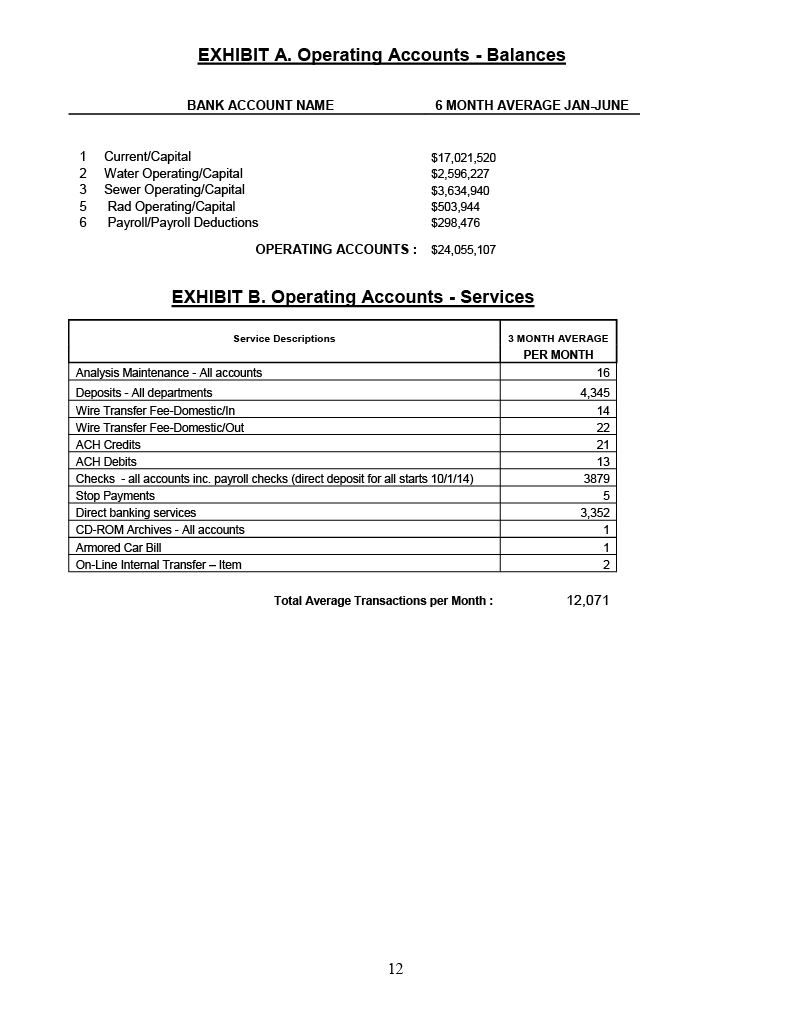

These pages from an RFP published by the city of Millville, New Jersey, offer an excellent example of what you can might see from a deposit and transaction standpoint.

Differentiating in the proposal process.

When it comes to community banking, it's never just about technology. It's also never just about the people that are providing the services. It's a combination of both.

One of the best ways to differentiate your institution is by partnering with the city’s finance team to create smooth operating procedures. Instead of saying, “Here's our solution, and these are our processes and how they're being done,” you need to ask the people doing the work, “How are you currently doing it, and what are your pain points?” Armed with that information, you can find ways to provide either specific services or training to alleviate those pain points.

Preparing a winning proposal means doing as much work ahead of time as possible. Explore the city’s website and look for the annual budget report. Request the most recent RFP the city published – you may need to submit a Freedom of Information Act request to receive a copy. Assemble as many of the components mentioned in the RFP as possible ahead of time. That way, when a fresh RFP comes your way, you can focus on customizing and polishing your response, not building the whole proposal from scratch.

Build a competent specialty deposits team.

For some institutions, the thing holding them back from pursuing municipal clients isn’t a lack of understanding or desire for the deposits. It’s a lack of capability within the bank. Your institution could have the balance sheet and the technology required to win a municipal contract bid but still fall short.

You need a team of commercial bankers committed to understanding the particulars of municipal clients and creating processes to serve those clients with efficient, creative, and compliant solutions. Few things will undermine your bank’s reputation like promising that you can deliver a high level of service and disappointing your clients when the rubber meets the road. Before you build a proposal, you need to create buy-in and gain team alignment on your specialty deposit strategy.

Free resources for pursuing municipalities as commercial banking clients.

If you’d like to learn more about the municipal RFP process and how your institution can prepare winning proposals, check out the replay of our recent webinar on municipalities. You’ll also find other free resources, including a downloadable information sheet for your specialty deposits team.

- Press (53)

- Commercial banking (16)

- Deposits (14)

- Partnerships (12)

- 1031 Exchanges (9)

- ZEscrow (9)

- Bank tech (8)

- Specialty Deposits (8)

- ZValues (6)

- Property Management (5)

- VAM (4)

- Law Firms (3)

- Liquidity Management (3)

- Municipalities (3)

- Working smart (3)

- Podcast (2)

- Webinar (2)

- Builder, Banker, Hacker, Chief (1)

- FDIC Insurance (1)

- February 2026 (1)

- December 2025 (1)

- November 2025 (1)

- September 2025 (1)

- August 2025 (4)

- July 2025 (1)

- June 2025 (2)

- May 2025 (1)

- March 2025 (1)

- February 2025 (1)

- January 2025 (1)

- December 2024 (1)

- November 2024 (1)

- October 2024 (3)

- September 2024 (2)

- August 2024 (3)

- July 2024 (2)

- June 2024 (3)

- May 2024 (6)

- April 2024 (2)

- March 2024 (5)

- February 2024 (1)

- January 2024 (2)

- December 2023 (1)

- November 2023 (3)

- October 2023 (1)

- September 2023 (1)

- August 2023 (3)

- June 2023 (3)

- May 2023 (1)

- March 2023 (6)

- February 2023 (4)

- January 2023 (4)

- December 2022 (2)

- November 2022 (6)

- October 2022 (1)

- September 2022 (1)

- August 2022 (3)

- June 2022 (1)

- May 2022 (1)

- April 2022 (5)

- March 2022 (3)

- December 2021 (2)

- September 2021 (3)

- July 2021 (2)

- June 2021 (1)

- May 2021 (1)

- April 2021 (4)

- March 2021 (3)

- February 2021 (4)

- January 2021 (2)