Shoring up core commercial deposits with 1031 Exchanges

by Zac Garver on Mar 21, 2023 9:03:00 AM

As more financial institutions find their deposit portfolios shaken by the collapse of Silicon Valley Bank and other institutions, the value of stable deposits has jumped in recent weeks. Couple that instability with a climbing fed funds rate, and banks are looking for additional ways to shore up their core deposits. An excellent route is to target 1031 Exchanges as a high-volume source of commercial deposits.

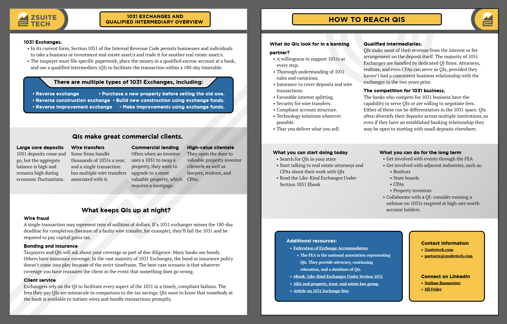

Our blog on 1031s offers a high-level explanation of like-kind exchanges, the qualified intermediaries (QIs) who facilitate them, and how they can fit into your specialty deposit strategy. If your institution is interested in exploring this specialized industry, there are concrete steps you can take to attract and retain them as commercial clients.

Qualified intermediaries bring in chunky core deposits.

The 180-day window for 1031s may suggest they belong in the time deposit category, like CDs, but that view is incorrect. Indeed, a few 1031s won’t make much of a difference for your deposit portfolio. You need to build relationships with QIs.The 1031 deposits you want to attract only come through a QI, even if that is a QI department you create within your institution, as some banks do. QI firms often handle thousands of 1031 transactions a year, which result in a high average balance when viewed in aggregate. Even during slow economic periods, property investors who favor 1031s are eager to take advantage of lower prices to maximize their income-producing real estate assets.

The 1031 industry follows strict compliance requirements that can vary for states with their own income tax and capital gains rules. QIs are looking for banking partners that understand their business and can provide support in the right areas. If you can meet their business needs and be fair-minded in your negotiations, you’ll go a long way toward winning loyal clients.

Discover how to attract qualified intermediaries to your bank.

If your commercial banking team is ready to add QIs to your specialty deposit portfolio, then watch our webinar on demand. It’s called The art of the possible: Becoming the go-to financial institution for 1031 Exchanges. You’ll hear ZSuite Tech’s CEO and Co-founder, Nathan Baumeister presenting alongside our Chief Client Officer, Jill Feiler. They both have a deep understanding of how commercial bankers can tap new sources of core deposits using niche industries, such as QIs.

Equip your sales team. Access the most important information captured in this new Information Sheet.

- Press (53)

- Commercial banking (16)

- Deposits (14)

- Partnerships (12)

- 1031 Exchanges (9)

- ZEscrow (9)

- Bank tech (8)

- Specialty Deposits (8)

- ZValues (6)

- Property Management (5)

- VAM (4)

- Law Firms (3)

- Liquidity Management (3)

- Municipalities (3)

- Working smart (3)

- Podcast (2)

- Webinar (2)

- Builder, Banker, Hacker, Chief (1)

- FDIC Insurance (1)

- February 2026 (1)

- December 2025 (1)

- November 2025 (1)

- September 2025 (1)

- August 2025 (4)

- July 2025 (1)

- June 2025 (2)

- May 2025 (1)

- March 2025 (1)

- February 2025 (1)

- January 2025 (1)

- December 2024 (1)

- November 2024 (1)

- October 2024 (3)

- September 2024 (2)

- August 2024 (3)

- July 2024 (2)

- June 2024 (3)

- May 2024 (6)

- April 2024 (2)

- March 2024 (5)

- February 2024 (1)

- January 2024 (2)

- December 2023 (1)

- November 2023 (3)

- October 2023 (1)

- September 2023 (1)

- August 2023 (3)

- June 2023 (3)

- May 2023 (1)

- March 2023 (6)

- February 2023 (4)

- January 2023 (4)

- December 2022 (2)

- November 2022 (6)

- October 2022 (1)

- September 2022 (1)

- August 2022 (3)

- June 2022 (1)

- May 2022 (1)

- April 2022 (5)

- March 2022 (3)

- December 2021 (2)

- September 2021 (3)

- July 2021 (2)

- June 2021 (1)

- May 2021 (1)

- April 2021 (4)

- March 2021 (3)

- February 2021 (4)

- January 2021 (2)